| |

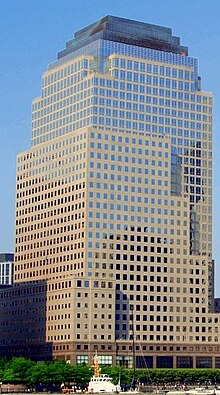

Headquarters at 250 Vesey Street Headquarters at 250 Vesey Street | |

| Company type | Private |

|---|---|

| Industry | Financial services |

| Founded | August 31, 1999; 25 years ago (1999-08-31) |

| Founders |

|

| Headquarters | 250 Vesey Street, New York City, U.S. |

| Products | High-frequency trading, Market maker |

| Number of employees | 2,631 |

| ASN | |

| Website | www |

Jane Street Capital is a global proprietary trading firm. It employs more than 2,600 people in six offices in New York, London, Hong Kong, Amsterdam, Chicago, and Singapore, and trades a broad range of asset classes on more than 200 venues in 45 countries.

It is among the principal market-makers – in 2020 it traded more than $17 trillion worth of securities. It was considered to have helped keep bond exchange-traded funds (ETFs) liquid during the market turmoil in 2020.

History

Jane Street was co-founded by Tim Reynolds, Rob Granieri, Marc Gerstein, and Michael Jenkins. Reynolds, Granieri, and Jenkins were formerly traders at Susquehanna International Group. It was started in either 1999 or 2000.

In 2012, Tim Reynolds stepped down from his position running the firm.

Activities

The firm ended 2020 having traded $4 trillion in global equities, $1.4 trillion in bonds, and $3.9 trillion in ETFs. During the COVID-19 pandemic, the firm saw its revenue jump 54% to a record of $10.6 billion during the year ended in March 2021.

As of 2021, its trading capital was about $15bn. As well as high-frequency trading, it in some cases maintained positions for hours, even days or sometimes weeks, which is essential for ETFs that track less-traded markets. On any given day, it was holding about $50bn of securities. It is an authorised participant in 2,600 ETFs and lead market-maker on 506 ETFs, and plays an important role in maintaining ETF liquidity.

In 2023, the company generated $10.6bn in net trading revenue with adjusted earnings of $7.4bn. It released these numbers as part of a debt deal which aimed to expand the amount of cash on Jane Street's balance sheet from $4.3bn to $5.6bn.

Technology

Almost all of its software is written in the OCaml programming language.

Leadership and culture

The company is informally led by a group of 30 or 40 senior executives.

The firm's culture includes a focus on the risks of improbable but catastrophic crashes. In addition to hedging at trading desk level, Jane Street at company level spends $50m-$75m a year on put options.

Lawsuits

In April 2024, the firm brought a lawsuit against Millennium Management alleging that Millennium stole its trading strategy through engaging two of its former traders, Douglas Schadewald and Daniel Spottiswood. The firm claimed the strategy, which traded options in NSE/BSE India, earned about $1 billion in 2023.

Notable past employees

- Zvi Mowshowitz

- Sam Bankman-Fried and Caroline Ellison, recipients of misappropriated FTX customer funds, were once employed by the company.

- Brett Harrison

- Renée DiResta

References

- ^ "Jane Street Capital, LLC :: Delaware (US) :: OpenCorporates". opencorporates.com.

- Patterson, Scott; Rogow, Geoffrey (August 1, 2009). "What's Behind High-Frequency Trading". The Wall Street Journal.

- "Jane Street Scores $10.6 Billion Trading Haul". Bloomberg.com. 17 April 2024.

- ^ "Our Story". Jane Street Capital. Archived from the original on August 31, 2017. Retrieved August 1, 2014.

- "Who We Are :: Jane Street". www.janestreet.com. Retrieved 2024-05-22.

- "What We Do :: Jane Street". www.janestreet.com. Retrieved 2018-08-08.

- ^ Wigglesworth, Robin (28 January 2021). "Jane Street: the top Wall Street firm 'no one's heard of'". Financial Times. Retrieved 29 January 2021.

- ^ "Jane Street's Reynolds Turns to Art With Trading Fortune". Bloomberg.com. 14 June 2019 – via www.bloomberg.com.

- ^ "The Poker Aces Playing a Key Hand in the $5 Trillion ETF Market". 20 November 2018.

- "Jane Street Capital, LLC: Private Company Information". www.bloomberg.com.

- "Division of Corporations - Filing". icis.corp.delaware.gov.

- "Financial Times". 28 January 2021.

- "Jane Street, DRW Traders Made Billions as Virus Hit Markets". Bloomberg.com. 18 June 2021.

- Boyde, Emma (September 28, 2020). "What are authorised participants?".

- ^ Wigglesworth, Robin (January 28, 2021). "Jane Street: the top Wall Street firm 'no one's heard of'".

- "Jane Street Scores $10.6 Billion Trading Haul". Bloomberg.com. 17 April 2024.

- "Automated Trading and OCaml with Yaron Minsky". Software Engineering Daily. November 9, 2015.

- "Technology :: Jane Street". Jane Street Capital. Retrieved 15 August 2023.

- "Jane and the Compiler". Jane Street Capital. Retrieved 15 August 2023.

- "Jane Street Open Source". Jane Street Capital. Retrieved 15 August 2023.

- "Big hedge fund firm Millennium sued by Jane Street for allegedly stealing strategy". Reuters.

- "Jane Street Strategy in Millennium Suit Involved India Trading, Hearing Reveals". Bloomberg.

- Parloff, Roger (August 12, 2021). "Portrait of a 29-year-old billionaire: Can Sam Bankman-Fried make his risky crypto business work?". Yahoo!Finance. Archived from the original on June 24, 2022. Retrieved September 6, 2021.

- De Vynck, Gerrit (2 January 2023). "Caroline Ellison wanted to make a difference. Now she's facing prison". Washington Post. Retrieved 4 January 2023.

- Wise, Aaron (2023-01-30). "How did so many Jane Street traders wind up at FTX?". Protos. Retrieved 2023-10-18.